SUBSIDY ON FUEL REMAINS UNTIL 30th JUNE 2022

By Amb. Emmanuel Mwamba

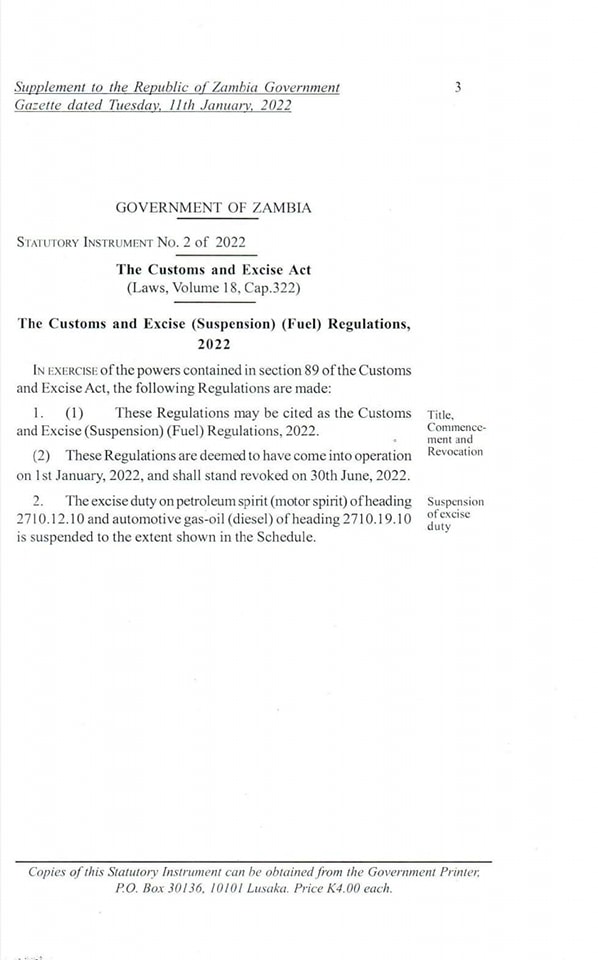

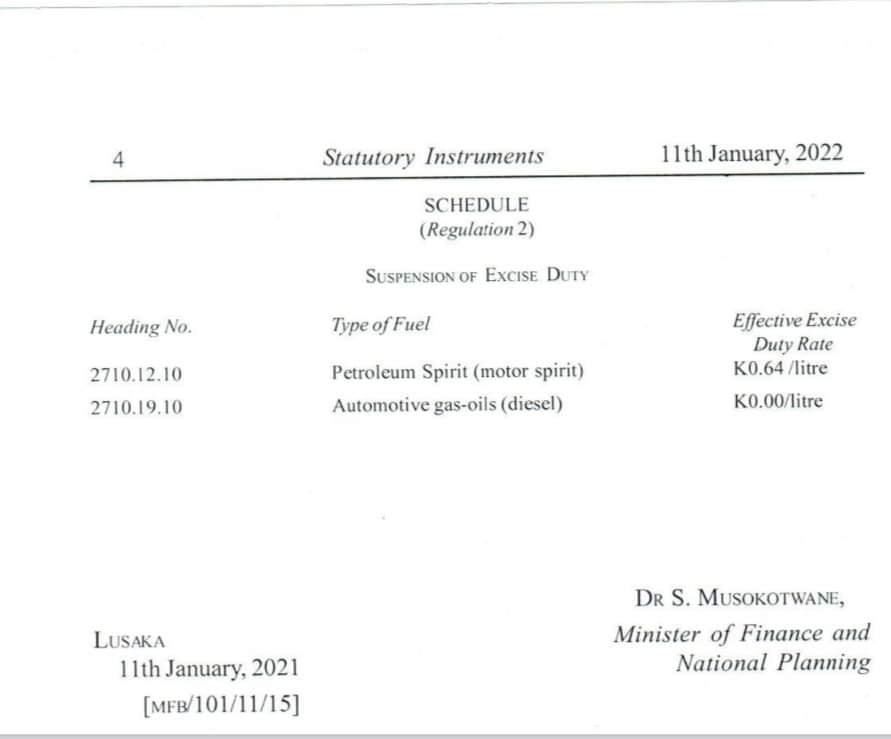

Minister of Finance Dr. Situmbeko Musokotwane has extended the suspension of customs and excise duty on petroleum products.

In a Statutory Instrument No.2 of 2022, dated 11th January 2022, the excise duty on petroleum and diesel remains suspended until 30th June 2022.

To prevent fuel increase, the previous government suspended collection of these taxes by the Zambia Revenue Authority.

WHAT DOES THIS MEAN

This is very good news to consumers as the pump price of fuel may not be increased just now and the rising cost of living maybe arrested as any further fuel increase could have seen escalating price increase in goods and services.

Government loses upto $41million a month in foregone revenue because of the suspension of collection by ZRA of these taxes.

Government also spends $26milliom in price differential on volatile exchange rate, world oil price and uniform pricing of pump price scheme across the country.

This development however, may threaten an approval of Zambia’s Programme by the Board of the IMF where the Minister of Finance pledged to remove subsidies on fuel, and promised to charge cost reflective tarrifs on electricity and reduction of expenditure on the FISP Programme.

On 3rd December, 2021 IMF announced that it had reached a Staff-Level Agreement with the Zambian Authorities on a new arrangement under the Extended Credit Facility for 2022-2025.

The government’s bold and ambitious reform program, supported by the IMF, seeks to restore fiscal and debt sustainability, create fiscal space for much needed social spending, and strengthen economic governance and transparency.

To complement the authorities’ strong reform program a comprehensive debt treatment under the G20 Common Framework is needed to restore debt sustainability.

The IMF Executive Board’s consideration of this agreement is subject to progress on this front.

(A subsidy is a benefit given by the government to groups or individuals, or sector and is usually in the form of a cash payment (direct) or tax reduction (indirect))