🇿🇲 VIEWPOINT | Who is Buying Zambia’s Bonds and Why It Matters

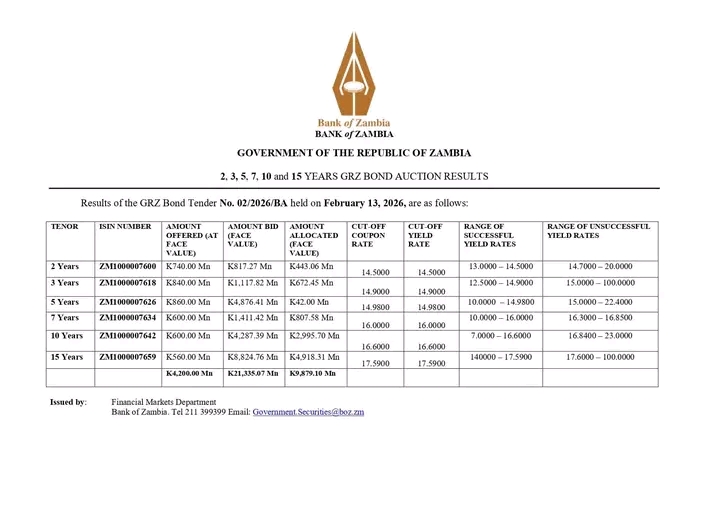

When headlines say over K21 billion chased Government of the Republic of Zambia (GRZ) bonds at the latest Bank of Zambia auction, many citizens understandably ask a simple question: who is buying all this debt?

The bond market can sound like an elite conversation, distant from ordinary life. Yet in reality, these auctions are not just about finance. They are about trust, stability, and the kind of economic system Zambia is slowly rebuilding after years of fiscal strain.

To understand why this matters, one must first understand the people shaping Zambia’s recovery.

The biggest buyers of GRZ bonds are not individuals walking into a bank with cash. They are large, regulated institutions that manage long-term pools of money. Commercial banks invest in government securities as part of their balance sheet management. Pension funds invest contributions from workers across Zambia to generate stable returns over time. Insurance companies also participate because they must place premiums in assets that are predictable and safe. Increasingly, foreign institutional investors join in when they sense macroeconomic stabilisation and improving policy credibility.

In short, when demand surges, it is often a signal that professional capital is becoming more comfortable with Zambia’s direction.

Government bonds are essentially a structured loan to the State. Investors buy them because they offer a defined return, backed by the government’s obligation to repay. For pension funds, this matters deeply. A pension fund is not looking for quick profits. It is looking for long-term certainty, because it must pay retirees years into the future. Banks use bonds as a relatively low-risk way to earn interest while balancing liquidity. Insurance firms rely on bonds to provide stable income streams that match long-term liabilities.

So when the bond auction attracts record demand, it reflects something larger than money chasing yield. It reflects confidence in the State’s ability to honour its commitments.

Zambia’s bond market is responding to a shifting macroeconomic narrative. Inflation has eased into single digits. The Bank of Zambia has begun cutting the policy rate. Reserves have improved. Copper prices remain supportive. Investor confidence has been strengthened by the IMF programme and restructuring progress. These factors create the foundation investors require: predictability. Markets do not reward perfection. They reward clarity, and the bond auction is one of the clearest places where that confidence shows up in real numbers.

The bond market is not an abstract scoreboard. It affects the real economy in several ways. When government can borrow at more sustainable rates, it reduces pressure on the national budget. When interest costs stabilise, fiscal space slowly opens for infrastructure, health, and education. A functioning bond market also reduces dependence on external borrowing, because domestic financing is more controlled and less exposed to foreign currency shocks.

Strong demand for long-term bonds suggests investors are not only betting on the next month. They are betting on Zambia’s trajectory over years. That is not a small signal.

This confidence, however, remains fragile. Bond demand can reverse quickly if inflation returns, if fiscal discipline weakens, or if political uncertainty disrupts the reform path. Oversubscription is not a trophy. It is a responsibility. Borrowing must remain disciplined, and spending must remain transparent.

The real headline is not simply that Zambia attracted K21 billion in bids. The headline is that Zambia is slowly rebuilding an institutional investor ecosystem, where pensions, banks, insurers, and global capital begin to treat the country as investable again. This is how economies normalise, not through slogans, but through markets quietly voting with money.

The bond market is not for elites alone. It is one of the clearest mirrors of national credibility.

© The People’s Brief | Ollus R. Ndomu