🇿🇲 VIEWPOINT | Zambia’s Rate Cut Signals Confidence, But Reality is Still Harsh

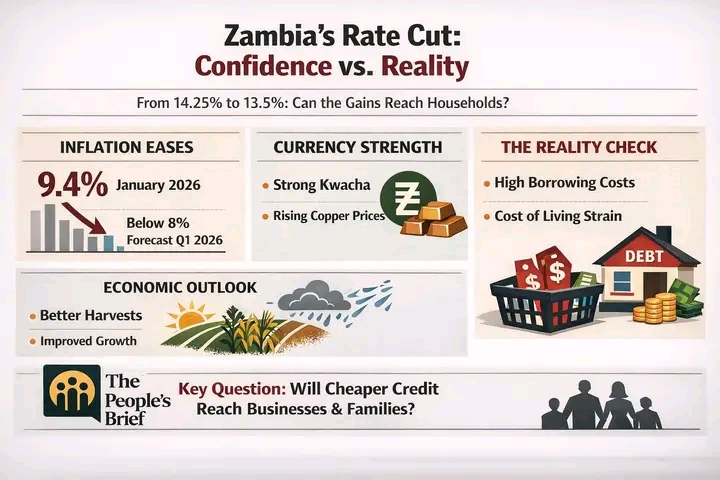

The Bank of Zambia’s decision this week to cut its Monetary Policy Rate by 75 basis points, from 14.25% to 13.5%, is more than a technical adjustment. It is an economic signal. After years of volatility, the central bank is beginning to act less like a firefighter and more like a manager of recovery.

The move comes as inflation eases sharply, falling from 11.2% in December 2025 to 9.4% in January 2026. The central bank has also projected inflation could drop below 8% within the first quarter of this year. In a region where price pressures remain stubborn, Zambia’s disinflation trend is starting to look structurally anchored rather than accidental.

For markets, this is a meaningful pivot. Monetary easing is only possible when policymakers believe inflation expectations are stabilising. In that sense, the rate cut reflects growing confidence that the inflation shock of recent years is fading, giving the central bank space to support growth.

The macro backdrop is improving on several fronts.

A stronger kwacha has helped contain imported inflation, particularly for fuel, fertiliser, and other dollar-priced inputs. Copper prices, Zambia’s external anchor, remain supportive, while mining activity has shown renewed momentum. These forces have strengthened foreign exchange inflows and reduced pressure on the currency, offering the Bank of Zambia additional policy room.

Weather has also played a role. The central bank has pointed to a more favourable 2024/2025 rainy season, which improves agricultural supply conditions and reduces food-driven inflation risk, historically one of Zambia’s most persistent price triggers.

Taken together, these factors suggest Zambia is entering a more stable macro phase: easing inflation, firmer currency performance, improving commodity support, and a policy environment less dominated by crisis response.

Still, a rate cut is not the same as a recovery.

The key question is transmission. Will lower policy rates translate into cheaper credit for firms, households, and productive sectors? Zambia’s borrowing environment remains constrained by high lending spreads, risk pricing, and weak private-sector credit depth. Monetary easing can stimulate growth only if commercial banks respond, and if businesses have the confidence to invest.

There is also a political economy dimension. With elections approaching later this year, any macro improvement will be tested against lived experience. Inflation may be falling, but the cost of living remains elevated. Rate cuts support investment over time, but households feel prices immediately.

For ordinary Zambians, the central bank’s shift offers cautious optimism: more stable prices, easing pressure on borrowing, and the possibility of stronger business activity. But the benefits will depend on whether growth broadens beyond macro indicators into jobs, incomes, and affordability.

Zambia’s economic narrative is turning. The Bank of Zambia is signalling that inflation is increasingly under control and that policy can now lean toward expansion rather than restraint.

The challenge now is ensuring that stability becomes opportunity, not just statistics.

© The People’s Brief | Ollus R. Ndomu