By Amb. Emmanuel Mwamba

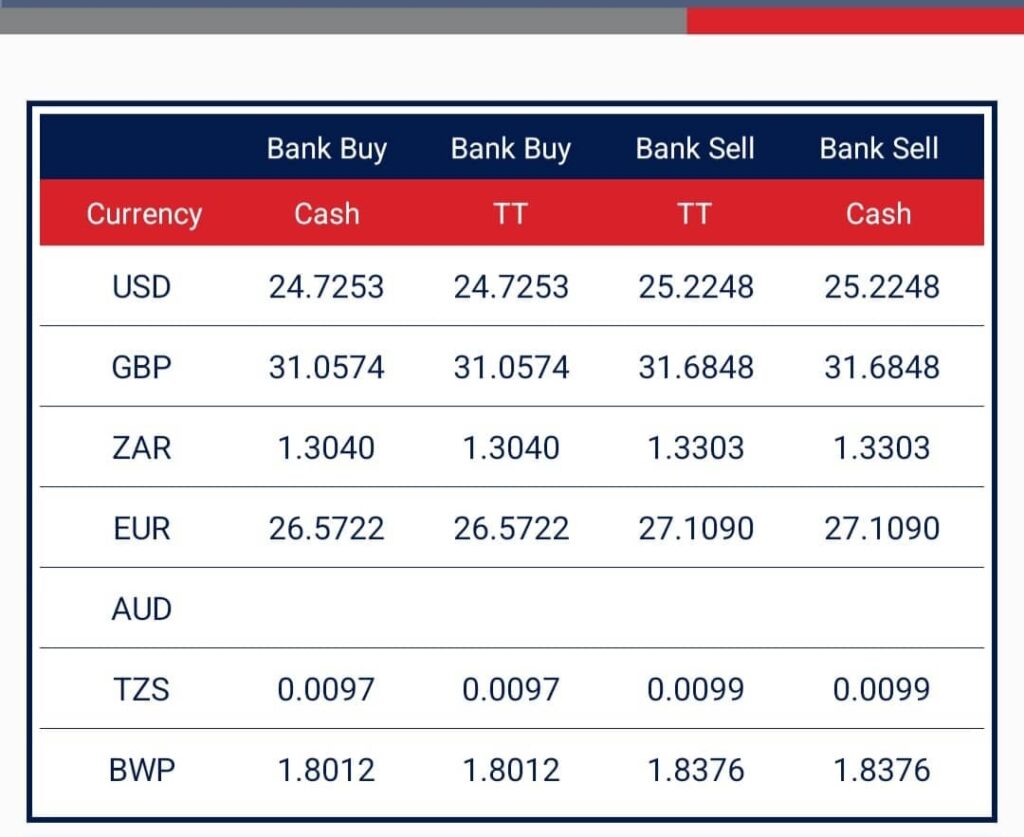

K25.2, We Have Spent $US$215MILLION TO SUPPORT THE FOREIGN EXCHANGE MARKET-BOZ

Bank of Zambia Governor, Denny Kalyalya, when presenting the decisions of the Monetary Policy Committee that held its meeting on February 12-13, 2024 stated that the economy was doing very badly and was “overheating”.

He bemoaned the rise in inflation(annual inflation rising to 13.2 percent) and the continued instability in the foreign exchange market.

He proceeded to announce some of the harshest measures and draconian monetary policy to curb inflation and stabilise prices and exchange rate market.

Below are some of the fiscal and monetary measures that have been undertaken;

● The Monetray Policy Rate has been raised by 150 basis points from 11.0 percent to 12.5 percent.

● to moderate volatility and broadly support the importation of critical commodities, Bank of Zambia has offloaded $215.5 million on the foreign exchange market.

● the Statutory Reserve Ratio was raised by 900 basis points from 17.0 percent to 26.0 percent with effective from 5th February 2024.

●$461million(K12billion) mopped to BOZ-Government introduced the ZERO-BASED BALANCE accountsbfor Ministries, Provinces and Government Agencies (MPAs). To this effect, government moved funds totalling K12billion ($461million) from commercial banks to Bank of Zambia. All funds in Commercial Bank Accounts to the Credit of MPAs was mopped to the Mopping Account at Bank of Zambia.

● All funds in Commercial Bank Accounts to the Credit of Ministries, Provinces and Government Agencies mopped and repatriated to the Mopping Account at Bank of Zambia.

● Turn-over in the interbank foreign exchange market reduced significantly to $14.4million from $185million in the previous quarter due to low supply.

● In the fourth quarter alone of 2023, the Kwacha depreciated by 17.5% against the US dollar and the depreciation continued to 4.6 percent as at 13th February 2024.

The Bank of Zambia (BoZ) has formulated and implemented these monetary and supervisory measures that should achieve and maintain price stability and promote financial system stability.

But all these measures remain temporal and not sustainable;

● The ultimate solution lie in economic activities and boosting export trade that should earn the country foreign exchange and the subsequent retention of export proceeds in local banks.

● abandon the tax and other incentives that have been given to the mining sector.

As always, Mr. Mwamba is talking about things he doesn’t understand. To start with, it’s the duty of the central bank of any country to monitor and manage money supply in a country so I don’t see anything wrong with them “mopping” all the excess money in the economy which are not being applied in productive economic activities.

Secondly, overtaxing does not bring more more revenue to the treasury but instead it kills the very sector being overtaxed. He is talking about removing “incentives” from the mining sector proposing overtaxing the mines forgetting that this is the very direction which almost killed the once vibrant mining industry in the country.

Maybe just to educate the man, tax incentives encourage investment in those sectors and this is practiced worldwide. For Mr. Mwamba’s information, USA government has given tax incentives to computer chips manufacturing companies in form of chips act to a tune of $52bn to encourage investment in production of computer chips within the USA. But this man wants the government to overtax companies instead of encouraging more incentives to other sectors as well so that we can grow the tax base but he is forgetting that such acts kills the very industry resulting in no revenue for government from these companies once they fold due to overtaxation. Can this man think for once before he writes anything?

Mwamba will not appreciate that good things take long to actualize. It is no accident that both KCM and Mopani among others have started pumping dollars in the economy.

Tax holidays to the mines has been the narrative by the opposition since UPND formed government. On the contrary there are no such tax holidays. What government has done is to stop the double taxation suffered by mines. They want the mines to be taxed on the mineral royalty that has already been paid.

They should ban the exportation of raw minerals. Add value within, then export. We have galavanted enough across the globe. Let the galavanting bear fruit