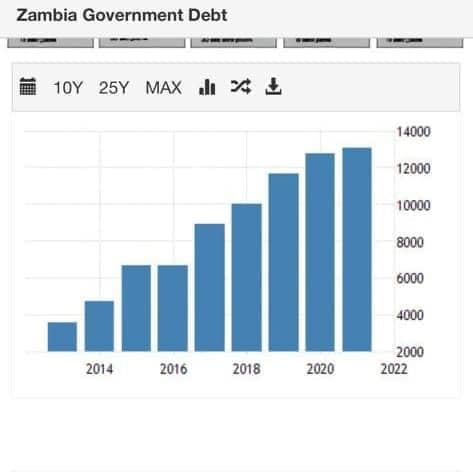

REALITY ON ZAMBIA’s TOTAL DEBT

As at December 2022, Zambia’s public debt stood at $31.5 billion, excluding interest arrears on external debt and $32.8 billion, including interest arrears of $1.3 billion since we have not been servicing the debt for close to 2 years.

Of the $32.8 billion total public debt, $14.23 billion represents local currency domestic debt broken down as follows:

- Treasury Bills $2.21 billion

- Government Bonds $9.40 billion

- Domestic Arrears $2.45 billion

- Others $0.8 billion

(Source Ministry of Finance)

Government funds its day to day operations mostly from Treasury Bills and Government Bonds auctions, which are now unfortunately failing as demonstrated in the last two Government Bond auctions.

It’s very important also to note that domestic arrears mostly relate to local contractors who have not been paid. This partly answers the issue of lack of liquidity in the market as local contractors are not being paid.

Our concern is that no one seems to be paying any attention to the the domestic debt issue. The risk on domestic debt default, which will be catastrophic should it happen is not being addressed.

How would such an event arise?

If government fails to pay Treasury Bills and Government Bonds upon maturity a default can arise. Government uses part of the Treasury Bills and Government Bond auction proceeds to service the maturities. In the event that auction proceeds are not sufficient the treasury has to source funds elsewhere to service the maturities. Given the recent bond auction failures, treasury must be under stress to service these obligations and if the trend continues, then a domestic debt default could materialise.

We should mention that on the unsecured $2.45 billion Domestic Arrears, a default has already happened as contractors are not being paid.

We request the Ministry of Finance to provide us with a future outlook on how domestic debt is being managed. We need domestic debt reduction as much as we need external debt reduction, but this is being overlooked.

Let’s be reminded that when debt restructuring is concluded the interest arrears of $1.3 billion will need to be paid. Even if a haircut is achieved, a substantial sum still needs to be paid together with principal arrears.

The only way out of this dilemma is to increase domestic revenue mobilisation by abolishing mining tax exemptions, growing the domestic tax base, new industries coming on board, job creation, value addition and so on and so forth.

Again, the call for a comprehensive economic plan which addresses issues raised above is urgently needed to address these serious concerns. Instead we are embroiled in a not so helpful graphs and Catholics debate and overlooking real issues.

Fred M’membe