By Amb. Emmanuel Mwamba

Bane, these tax measures are oppressive in this 2025 Budget

….Production of T-pin amd Tax Clearance Certificate to become mandatory on almost all local foreign transactions including payments on NHIMA, loans, Mobile money, and collection of title deeds and land transactions….

1. 15% tax on remittances of $2000.00 and above

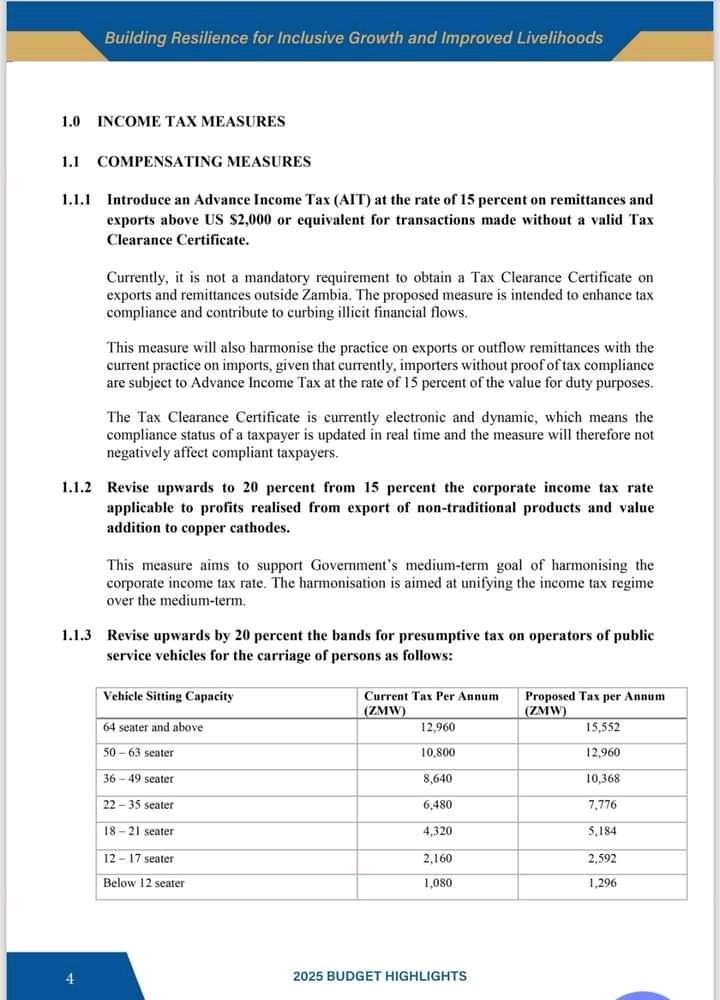

● Introduce an Advance Income Tax (AIT) at the rate of 15 percent on remittances and

exports above US $2,000 or equivalent for transactions made without a valid Tax

Clearance Certificate.

2. Make a General Tax Clearance Certificate (TCC) a mandatory requirement for the

following transactions:

(i) when transferring property;

(ii) when obtaining any licence issued by a Government ministry, department or

agency; and

(i) when obtaining finance from any institution registered under the Banking

and Financial Services Act.

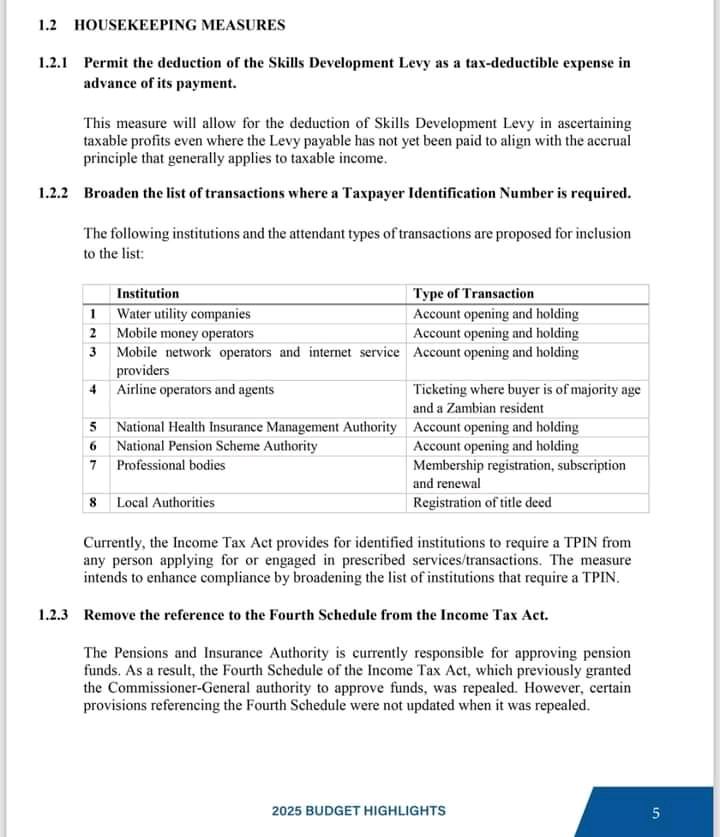

3. Broaden the list of transactions where a Taxpayer Identification Number is required.

●The following institutions and the attendant types of transactions are proposed for inclusion to the list:

Type of Transaction Institution

a) Water utility companies- Account opening and holding

b) Mobile money operators- Mobile network operators and internet service providers

c) Airline operators and agents- Ticketing where buyer is of majority age and a Zambian resident,

d) National Health Insurance Management Authority,

e) National Pension Scheme Authority

d) Professional bodies Membership registration, subscription and renewal

e) Local Authorities

Registration of title deed

Where are they oppressive when all they seek to address is compliance. No one will do business without being tax compliant. How can it be wrong for govt to charge 15% on transactions from companies or individuals seeking to send money abroad but are not cleared for tax purposes in Zambia or do not actually have tax clearance for that. This guy is mad because they will not be sending or receiving illicit monies without ZRA knowing about it.