BOZ puts Further Squeeze on Money Circulation

…liquidity in economy to dry up with the latest move, Zambians to suffer

02.01.23

By Staff Reporter

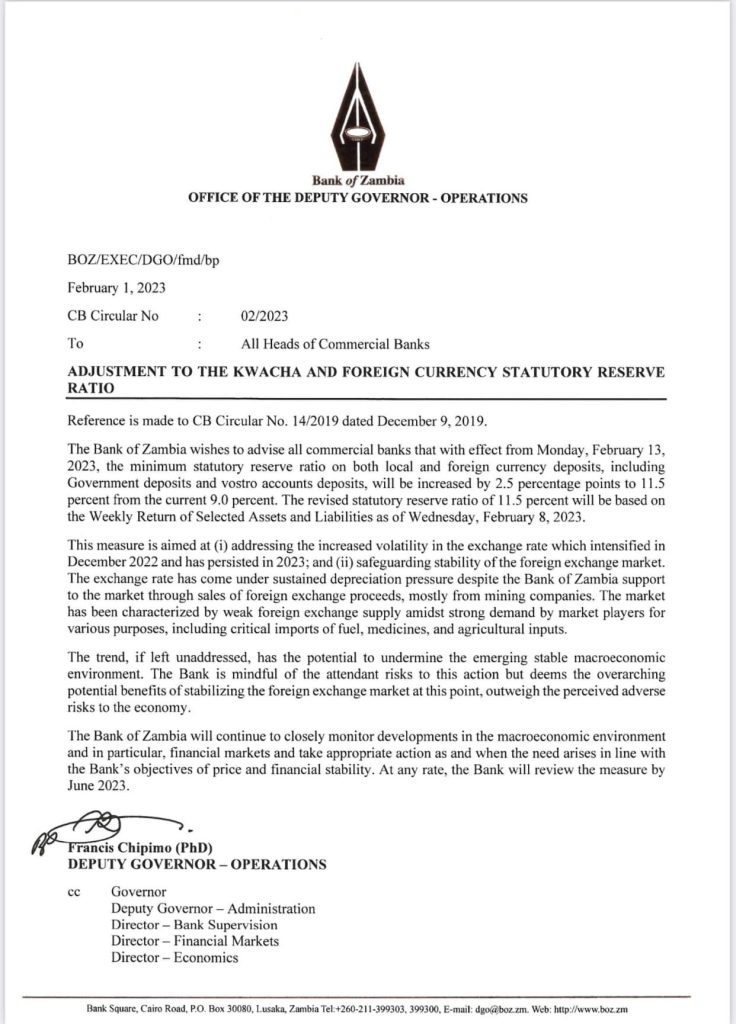

The Central bank has issued an instruction to commercial banks in Zambia to reduce money circulation further by increasing the statutory reserve ratio it holds said the Bank of Zambia (BOZ) in a statement dated 1st February 2023.

The statutory reserve ratios, “will be increased by 2,5 percentage points to 11.5 percent from the current 9.0 percent. The revised statutory ratio of 11.5percent will be based on the weekly return of selected assets and liabilities from next Wednesday 8th February 2023.”

Economic analysts say in lay terms or simple language, the BOZ move has effectively “squeezed” money or “liquidity” out of circulation which will force commercial banks to only deal or lend money to “pristine” clients like mines or big business.

“The ordinary already poor Zambian shall suffer even more as money is squeezed out of the market and suppliers are not paid, its going to be tough for many poor Zambians,” said an analyst in a local commercial bank.

To put the latest matter into simple perspective, what BOZ has done is like, “your commercial bank increases the balance it must hold on to your savings account by K500, if you have K1000, you can now only access K500. They must always hold your K500.”

Analysts say what the central bank should have done “if it was up to the task” was to “free” more money into circulation on the already depressed economy of Zambia rather than put a tighter squeeze that shall affect Zambians and the entire economy adversely even further. This is bad economics.

Diesel prices in Zambia have increased by almost K30 per litre which will also see food prices, transport fares rise further in coming months hurting Zambians even more, against the promises of President Hichilema promising to reduce the high cost of living.

Interest rates are also expected to rise in coming weeks following the Denny Kalyalya led BOZ after this uninformed economic move according to analysts as the kwacha value drops and fuel prices rise.