China has taken action to address Zimbabwe’s debt situation by cancelling unspecified amounts of interest-free loans and committing to assisting the country in navigating its debt crisis. This move comes amidst concerns raised by activists regarding the potential entrapment in a perpetual debt cycle. As of September 2023, Zimbabwe’s publicly guaranteed debt totaled $17.7 billion, with $12.7 billion external and $5 billion domestic. A significant portion of the foreign debt originated from China, as Zimbabwe became ineligible for loans from multilateral creditors like the World Bank and the International Monetary Fund (IMF) due to defaults dating back to the early 2000s.

Since the ousting of long-time leader Robert Mugabe six years ago, the country has struggled to negotiate debt restructuring agreements with its creditors. The debt restructuring dialogue, led by former Mozambican president Joachim Chissano and African Development Bank president Akinwunmi Adesina, faced setbacks when the United States withdrew support due to perceived reluctance from Harare to implement reforms.

China, now the largest non-Paris Club creditor for Zimbabwe, has expressed readiness to support the country in overcoming its debt challenges. While estimates suggest Zimbabwe’s debt to China may be around $3 billion, the exact amount of loans written off remains undisclosed. However, observers speculate that the write-off may not be substantial, considering Zimbabwe’s continued borrowing from China for infrastructure projects post-Mugabe era.

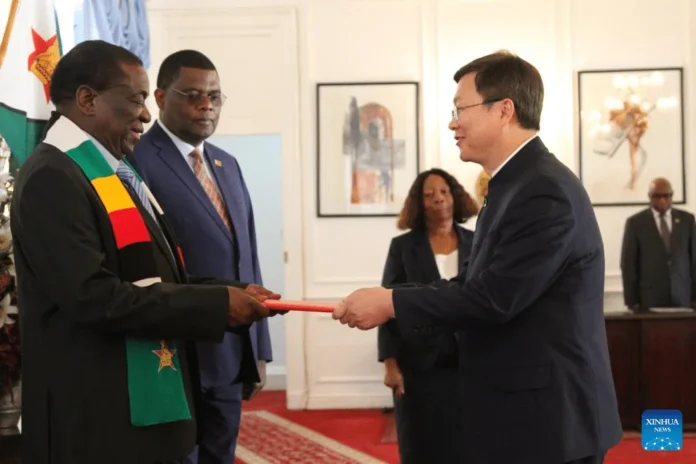

President Emmerson Mnangagwa’s administration has continued heavy borrowing from China, though China’s ambassador to Zimbabwe, Zhou Ding, refuted claims of Zimbabwe falling into a debt trap due to excessive Chinese loans. Zhou highlighted that Zimbabwe’s debt to Western countries and international financial institutions comprises the majority of its external debt, with China’s share being relatively smaller.

China’s announcement of interest-free loans to several African countries in 2022 was seen as a move to counter accusations of “debt-trap diplomacy.” Critics allege that it deliberately lends to countries unable to repay, aiming to enhance its political leverage against US influence in Africa. China denies these accusations, asserting its non-interference policy in other countries’ affairs.

Zimbabwe Coalition on Debt and Development (Zimcodd) warned of a perpetual debt trap due to past loan defaults, economic challenges, and limited access to concessional finance. Recent loans, such as the $400 million from Afreximbank, have been secured against the country’s platinum reserves. Zimcodd emphasized the risk of permanent debt overhang if the crisis remains unresolved, constraining development and forcing difficult choices between serving the people’s needs and managing debts.

The loans have primarily financed upgrades to international airports and expansion of thermal and hydroelectric power stations.