By Zambian Watchdog (21 June 2015)

HOW MEANWOOD ZULU GRABBED INVESTRUST BANK FROM FRIDAY NDLHOVU

For 20 years, Friday Ndhlovu did everything in his name, powers, skills and knowledge to raise Investrust, an indigenous bank from nothing.

Sadly, Friday Ndhlovu is now languishing at some farm after Robinson ‘Meanwood’ Zulu and Rupiah Banda grabbed his bank, which he has suffered to create and build to its current international status.

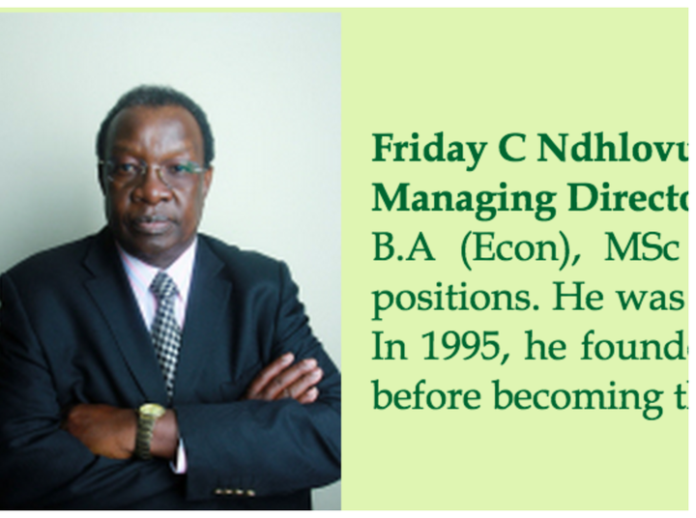

After working as Managing Director for ZANACO, Friday Ndhlovu in 1995 founded Investrust Merchant Bank. He was the executive chairman, meaning he was the head of the board and management. This is how most emerging companies are run.

But in 2000, as the company grew, he relinquished his dual role by giving up the position of board chairperson. He became the managing director. Dr Justine B Zulu took over as chairman. The bank continued to grow in assets and branch network.

As a Public Limited Company, the bank listed on the Lusaka Stock Exchange in 2007. Earlier in 2002, the bank had changed its name from Investrust Merchant to Investrust Bank PLC.

Being listed on the Stock Exchange meant that members of the public could purchase shares in the company. That is how Robinson Zulu of Meanwood and Rupiah Banda came in the picture.

By April this year, Meanwood Zulu by himself and through other agents had acquired enough shares in the bank to push out the founder and formerly majority shareholder Friday Ndhlovu.

So on May 1, 2015, Friday Ndhlovu was kicked out as managing director of Investrust.

He was replaced by no other than Richard Chembe, an associate, confidante and former economic advisor for Rupiah Banda during his short, corruption filled presidency. Even Dr Justine B Zulu was removed as chairman and replaced by Dr. Jacob. M. Mwanza.

It was Dr Mwanza who announced the dismissal of the bank’s legitimate owner and founder .

In April, a source close to the case told the Watchdog that, ‘There has been a corporate “coup” at Investrust Bank resulting in major shareholder Friday Ndhlovu losing his job of CEO.

It is said that the instigator of the move was a once trusted friend and confidant of Mr. Ndhlovu, Robinson Zulu of Meanwood Investments. The latter has over the recent past been scooping up Investrust Bank shares on the LuSE thus amassing up to 20% stake in the bank. The move has been justified on basis of Investrust’s poor financial results in the last two years. However, what is interesting is how Zulu whose Meanwood Financial Services business has been struggling and may soon lose its license can throw mad at Friday Ndhlovu. Mr. Ndhlovu has been replaced by Dr. Richard Chembe, former Economic Advice to RB.

The source further said:

‘Apparently, the real reason behind Ndhlovu’s firing has been a settlement of old scores. Mr. Ndhlovu as Chairman of the LuSE Board is said to have influenced the Board not to renew the contract of Beatrice Nkanza, who was LuSE CEO before Brian Tembo.

‘ Now, Beatrice Nkanza is the older sister to Womba Kamuhuza Zulu the wife to Robinson Zulu.

‘As one of the major shareholders Robinson has a seat on the Investrust Board, which proxy is Eddie Samakai a brother to his wife. However, recently Robinson Zulu has been pushing for a second seat which was supposed to be given to Beatrice Nkanza. Ndhlovu together with other major shareholders have resisted this move as they all have only one seat each.’

That is how Friday Ndhlovu lost his job and the bank he built from nothing. He is now an old man and it is doubtful that he still has enough energy to start up something or get another job. But Meanwood Zulu is smiling, enjoying all the sweat of Friday Nhdlovu for 20 years. SOURCE: Zambian Watchdog

‘There has been a corporate “coup” at Investrust Bank resulting in major shareholder Friday Ndhlovu losing his job of CEO.

There it is. Friday Ndhlovu, took his eyes off the ball. Astute investors keep an eye on the market as that is his bottom line. A good example is the recent floation of Trump’s truth social company. Trump floated his company. But it was inevitable on the first day, the share value would go up due to the excitement of the market. But within a day or two after the excitement the value fell and Trump is reported to have lost a Billion dollars.

Sometimes it is better to be happy with the little that you have…Paul Cave of Cavmont was wise his move to get out when the going was good…

The propaganda starts from the scammers , the Criminals after Zambia’s assets and resources…a narrative is being concocted to justify what has been done at Investrust. No wonder Dolika Banda resigned as Chair of ZCCM – IH . She couldn’t stomach the rot that the Insatiable pockets were putting on her. DBZ, Mopani, and now Investrust….

Immediately you see Watchdog and Koswe trying to push a certain narrative, just know the deal stinks..the Unhinged Privatisation Criminals at it again.

Dolika Banda resigned because of the failure by the auditors to certify the accounts under her watch and that was an ethical act. Something that most people ignore, she is now Board Chairperson at Standard Chartered.

What were the issues that arose for the accounts not to be certified by the auditors, is the question you should ask. When you rely on facts from half baked journalists and innuendo this is what happens. As Board Chair Person at ZCCM it was under watch to address and resolve the issues in question.

What propaganda? My friend business is not for the faint hearted and fools. We have read what Mmembe did. Why does he get to walk away while employees lose their jobs? Noel Nkhoma stated the issue that was at play at DBZ. The abuse went as far as the MD. Isnt he in prison for the abuse that took place sending his kids aboard at the cost of the institution? If he was that compromised in his decisions, what about the manner in which loans were disbursed. The borrowers may have been companies. Lift the corporate “curtain” what are we affraid of? There should be no “untouchables”. Go after their personal assets. You will see a culture change in the business practices among people who get loans and dont pay back.

This plagued CEEC as well. We have a culture of getting money and failing to pay. That is disgusting and should be abhorant.

If your suggestion is about Friday Ndhlovu, I reiterate. When you go public, you open yourself to a can of worms. He lost his position in the company legally. He should have known better. Business is not some “fuzzy wazzy” game. Ask Andrew Sardanis (MHSRIP), ask Musa Siame and the late Mwanashiku of Mwanamoto Investments, BY Mwila all these men created and built empires. Where are those companies today?

If you trade in innuendo and misconceptions that is what happens. You come here like Mwamba and want to suggest propaganda…