MUSOKOKTWANE BRIEFS PARLIAMENT ON DEBT RESCHEDULE

MINISTERIAL STATEMENT ON DEBT RESTRUCTURING AGREEMENT BETWEEN #ZAMBIA & THE STEERING COMMITTEE OF THE ADHOC CREDITOR COMMITTEE OF HOLDERS OF ZAMBIA’S EUROBONDS

Madam Speaker, I want to thank you for according me this opportunity to update the House on a recent development in Zambia’s debt restructuring journey.

Madam Speaker, on Monday, 25th March 2024, Zambia agreed on terms of a restructuring agreement with the steering committee of the adhoc creditor committee of Zambia’s #Eurobond Holders.

Madam Speaker, let me briefly remind this august house of the milestones Zambia has achieved in the debt restructuring journey.

You will recall that in June of 2023, Zambia reached an agreement in principle on a comprehensive debt treatment covering about USD 6.3 billion of Zambia’s external #debt in principle with the bilateral creditors under the Official Creditor Committee (OCC). This agreement involves significant extension of maturities and a reduction in interest rates to provide the much-needed debt relief for #Zambia. Subsequently, in October of 2023, we agreed on a Memorandum of Understanding (MOU) with the OCC, to formalize the agreement reached in June.

Madam Speaker, following the agreement with the OCC, debt restructuring engagements with the private and commercial creditors, including the holders of Zambia’s Eurobonds also gained momentum. These engagements culminated into an agreement in principle on the key commercial terms of a proposed debt restructuring treatment relating to Zambia’s Eurobonds with the Steering Committee of the Ad Hoc Committee of the Eurobond holders, on 26th October 2023. However, Zambia could not proceed with this agreement because the OCC and the International Monetary Fund (IMF) had expressed their reservations regarding the agreed terms. Notably, Madam Speaker, we were able to revise the terms to be in line with the #IMF requirements. However, the OCC were still of the view that further effort was required from the Bondholders.

Madam Speaker, since October 2023, Government and the Steering Committee continued in rigorous and tireless good faith negotiations.

Madam Speaker, the job is finally done! I am here to announce that the Zambian Government and the Steering Committee of the Ad Hoc Committee of the Eurobond holders have reached an agreement on the key commercial terms of a proposed restructuring transaction relating to Zambia’s Eurobonds due in 2022, 2024 and 2027.

Madam Speaker, before I proceed further, let me state clearly that we have already obtained confirmation from the OCC and the IMF that this agreement complies with the Comparability of Treatment principle and the debt sustainability targets under the IMF program. Following this agreement, the #Bondholders will be invited to exchange and/or vote in favour of a consent to amend the terms of their Bonds for new fixed income instruments representing unsecured obligations of the Government, which may be referred to as “New Bonds”. The New Bonds are comprised of two bonds, Bond A and Bond B amounting to US $1.7 Billion and US $1.35 billion respectively.

Madam Speaker, similar to the agreement with the OCC, the agreement in principle which has been reached with the Bondholders also includes an adjustment mechanism involving a Base Case Treatment and Upside Case Treatment, dependent on Zambia’s future economic performances. Bond A matures in 2033 and pays 5.75 percent per annum in coupons until mid-2031, where the coupon increases to 7.5 percent. The financial terms of Bond A remain unchanged in both the base case and upside case treatments.

Bond B matures in 2053 in the base case scenario and 2035 in the upside scenario with interest being adjusted from 0.5 percent to 7.5 percent after 2025 in the upside scenario with a very large share of the coupon being paid in kind until 2031 to avoid direct cash outlays for the Budget and comply with IMF’s debt service to revenue targets. Under the Base Case Treatment, the weighted average maturity of the New #Bonds will be 15 years, while under the Upside Case Treatment, it will be 8 years.

Madam Speaker, under this agreement, the Bondholders will forego approximately USD 840 million of their claims through a haircut on the outstanding balance on the bonds and accrued interest, and provide approximately USD 2.5 billion in cash flow relief through reduced debt service payments during the #IMFProgramme period.

Madam Speaker, the portion of external debt which is subject to restructuring comprises official bilateral debt which accounts for approximately 50 percent. #Commercialdebt accounts for the other half, out of which Eurobonds also account for over 50%. Therefore, the agreements reached with the OCC and the Bondholders imply that out of the debt which is subject to restructuring, about 75% percent has been restructured, leaving only the debt owed to other commercial creditors.

Madam Speaker, you may be aware that since commencement of the debt restructuring exercise, Government has been implementing a debt service standstill to all the creditors whose debt is being restructured. Therefore, the implication of the agreement with the Bondholders and OCC is that Government will resume making debt service payments on the restructured debt. This requires funds to be made available in the budget to meet the obligations falling due. However, it should be noted that the debt service payments that will be made by the #ZambianGovernment will be significantly lower than what would have been paid if the debt was not restructured. This will free up financial resources which will channeled to other critical sectors of the economy. Government and the Bondholders are working around the clock to finalize the documentation required to implement the agreement. Most importantly, the debt agreement will further strengthen the confidence in our #economy and in our currency, opening the door to increased foreign direct #investment.

Madam Speaker, despite the milestones that we have so far achieved in the debt restructuring process, we still have more work to do. Firstly, we are hopeful of expedited #bilateralagreements with our official creditors in order to implement the terms of the debt treatment agreed in the October MoU.

Secondly, we will continue engaging other commercial creditors on a Non-Disclosure basis, with the determination of getting debt treatments on terms comparable to what has been agreed with both the OCC and the Bondholders.

Madam Speaker, as I conclude, I wish to express my sincere gratitude to our creditors and to all other stakeholders in the debt restructuring process, for their unwavering support and cooperation which has enabled us to reach this far. I also wish to reiterate Government’s firm commitment towards restoring long term debt sustainability and achieving long-term sustainable economic growth.

Madam Speaker, I thank you.

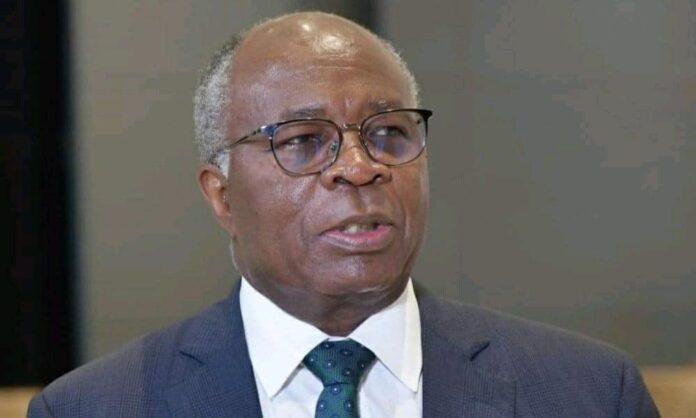

DR. SITUMBEKO MUSOKOTWANE, MP

MINISTER OF FINANCE & NATIONAL PLANNING