Earlier Debt Restructuring success was Sabotaged by President Hichilema and his officials

By Amb. Emmanuel Mwamba

Many Zambians are puzzled by the call by President Hakainde Hichilema to cooperating partners and donor countries that they should help with the delays in Zambia’s debt restructuring and reschedule program.

Zambians must be expressing surprise and puzzlement that a program that was heralded as a historical success and celebrations were held on the streets from the Kenneth Kaunda International Airport to Community House, now required urgent diplomatic help.

$3 BILLION BONDHOLDER RESCHEDULE SPOILS EVERYTHING

I alerted the country that the failure of the $3billion debt reschedule was being reported as a very big scandal in major western capitals and the development had jeopardized the earlier initial success reported in the $6.3billion debt reschedule.

We were ridiculed, rebuffed and told to shut up. ” Those that caused the mountain of debt must keep quiet!”, we were reminded.

But the scandal did not go away!

Here is a brief background and some aspects of the scandal;

1. On 26th October 2023, Dr. Situmbeko Musokotwane announced that Zambia had reached a historical milestone and agreed with External Bondholder Steering Committee to reschedule the $3billion Eurobond.

Zambia’s three international bonds rose sharply after the announcement, adding as much as 3.9 cents on the dollar.

There was hope that this development would restore full international capital markets access to Zambia and encourage long-term investment in the country.

ZAMBIA BREACHES G20 FRAMEWORK ON COMPARABILITY OF TREATMENT

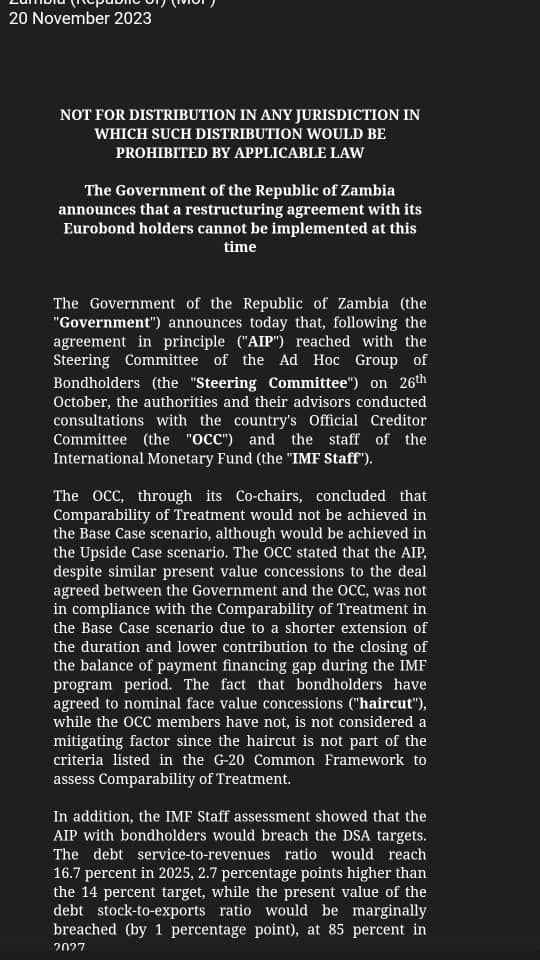

2. However, the International Monetary Fund (IMF) was the first to raise immediate alarm when the details of the Agreement-in-Principle (AIP) between Zambia and the External Bondholder Steering Committee, were known.

3. The Agreement raised the coupon value from $3billion to $3.135billion.

Who raises the face value of their debt in debt negotiations?

4. Zambia was to pay $2.5billion in cash-flow to the bondholders during the period of the $1.3billion IMF bail-out ( 2024-2025).

Where was Zambia going to obtain $2.5 billion to give bondholders in one fiscal year when the very reason of its program with the IMF was to seek a $1.3billion bail-out?

This would immediately send Zambia to debt distress status, the very crisis the debt reschedule program was trying to fix!

5. Despite the G20 framework provision on debt suspension, Zambia pledged to pay the Past Due Interest (PDI) accumulated to $821million. The G20 Framework provides that the Past Due Interest must be written-off, but Zambia pledged to pay and clear the outstanding.

Whose interest or who was going to be the beneficiary for Zambia to pay the $821million which the G20 Framework encourages that it must be written-off?

6. While China and other multilateral institutions agreed to a haircut or to a discount of 40% on Zambia’s debt, Zambia accepted a discount of 18% from the bondholders.

Again Zambia was agreeing to pay more instead of demanding a bigger hair cut beyond 40%!

ZAMBIA VIOLATES G20 FRAMEWORK

These terms were a clear violation of the G20 principles on equal treatment of debt and creditors.

The Common Framework was designed to coordinate debt relief offered by public and private lenders and set debt treatment standards across both traditional Western lenders and major new creditors like China, India and Saudi Arabia.

The Common Framework requires that a debtor country that signs a memorandum of understanding (MOU) with participating creditor countries to seek debt treatment from its other creditors that is at least as favourable as that of the MOU.

ZAMBIA RISKS ALL

The Official Creditors Committee immediately rejected the Agreement between Zambia and the bondholders.

China, France and the Paris Club threatened to cancel or renege on the $6.3billion debt reschedule earlier agreed in June 2023.

Newspapers in Paris, London, New York reported the development as a scandal.

Musokotwane was ordered to cancel the deal.

On 20th November,2023 Musokotwane announced that the Agreement-in-Principle would not be implemented due to objection from the Official Creditors Committee. He stated that the agreement had failed to meet the G20 Framework on Comparability of Treatment.

The announcement sparked a sharp rally in Zambia’s three outstanding bonds, which has been partially reversed since Zambia said on November 10 that official creditors and the IMF had “expressed reservations” about the deal, sparking fears that the country’s drawn-out default could be extended still further.

This was a setback and Zambia was back to the old scenario before the debt reschedule.

Meanwhile the G20 Framework on Debt Service Suspension Initiative (DSSI) has expired and Zambia is expected to start paying its debt!

Under this arrangement, Zambia has not been meeting its debt service obligation since December 20, 2020.

And as usual, President Hakainde Hichilema is looking for people to blame including the Patriotic Front or China!

Masekaseka, Emmanuel Mwamba, just go and say that about HH to your grandmother and she will tell you that you are insane.

HIV is troubling you, tell the Doctors that you need to increase the dosage. You’re a sick man sir.

You PF are the same people who brought this calamity on us are you not ashamed to even open your mouth and talk about this and who gives you all this information.

I have always said that the people who caused this debt problem must go to jail. You see now, instead of be remorseful, they are mocking us

But didn’t the Liar-in-Chief tell us whilst in opposition that he had so much credibility with creditors that once in power he was going to bring them together in one room and agree with them on restructuring Zambia’s debt? Just see how he is now clutching to straws by asking Western diplomats to help out. The chickens are coming home to roost and he is being called out for his bluff.