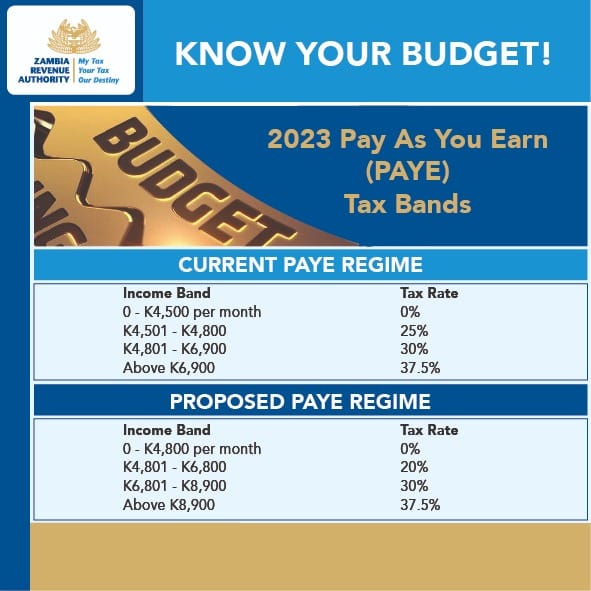

Government has increased the Pay As you Earn (PAYE) tax threshold from K4, 500 to K4,800 in next year’s national budget.

This means that only employees getting paid K4,800 and above will be taxed Pay As You Earn.

Presenting the K167 billion proposed 2023 national budget in Parliament today, Minister of Finance and National Planning, Situmbeko Musokotwane said the move is meant to mitigate the cost of living for many Zambian citizens.

Dr. Musokotwane said the measure will add 21,509 more workers to those who do not currently pay this tax on account of being below the PAYE threshold.

“The measure will also increase disposable income for salaried households by K1 billion,” he disclosed.

The minister also proposed to increase tax credit for persons with disabilities to K600 per month from the current K500.

He further proposed the abolishment of the current two-tier taxation system in the telecommunication subsector, which provided for 30 percent tax on profit of up to K250,000 and 40 percent on profit above K250,000, and replace it with a single tax rate of 35 percent.

Meanwhile, the government has proposed an increase of the Constituency Development Fund (CDF) allocation for the 2023 budget to each constituency from K25.7 million to K28.3 million, which is an increment of K2.6 million.

Dr. Musokotwane said increased CDF allocation is an overall K4.4 billion, which is an increase of K401 million from the 2022 national budget.

He stated that this will address the challenges faced by communities especially in rural areas.

“Priority will be on improving water and sanitation at health and education facilities, procurement of school desks, electrification of schools and hospitals as well as provision of maternity services at health centres,” he explained.

Meanwhile, Dr. Musokotwane proposed to spend K66.2 billion or 39.5 percent of the budget on the General Public Services function.

He said of this amount, K30.5 billion will go towards domestic debt servicing while K18.2 billion is for external debt service.

“The allocation towards debt service does not take into account debt restructuring and will be subject to change once an agreement is reached with creditors. We appeal to our creditors to support us so that, together, we can expeditiously conclude the debt restructuring,” Dr. Musokotwane said.

And Dr. Musokotwane expressed worry that Zambia’s mineral production has stagnated in comparison to the Democratic Republic of Congo (DRC).

He said Zambia’s mineral production has for many years stagnated at around 800,000 metric tonnes while DRC is performing better.

He has therefore announced the restructuring of the mineral royalty regime as a measure for Zambia to regain its glory in the mining sector.

“The tax will now apply on the incremental value in each adjusted price band as opposed to the aggregate value when the price crosses the respective price threshold.

I further propose to reduce the lowest marginal rate to 4.0 percent from 5.5 percent. The revenue loss from this measure is estimated at K2.8 billion,” he said