STATEMENT ON IMPLEMENTATION OF THE 2024 NATIONAL BUDGET

Welcome and happy new year.

Today we focus on 2024. We are still collecting data on 2023 budget performance. It will require analysis before being shared.

The briefing has been convened to share points of emphasis on the 2024 Budget presented to Parliament on 28th September, 2023, approved on 14th December, 2023, and which came into effect on 1st January, 2024.

The 2024 Budget is K177.9 billion.

It is expected to be funded from 3 key sources, namely:

1) K141.1 billion domestic revenues translating to 79 percent of the budget;

2) K3.4 billion as expected grants from co-operating partners translating to 2 percent of the 2024 Budget; and,

3) Financing (borrowing) amounting to K33.3 billion & translating to 19 percent of the budget or 5.2 percent of GDP.

In the 2024 Budget, the Government has set out key objectives targeted at unlocking Zambia’s economic potential.

These are:

1) Attaining a real GDP growth rate of at least 4.8 percent;

2) Reducing inflation to the 6-8 percent medium-term target band;

3) Maintaining international reserves above 3 months of import cover;

4) Increasing domestic revenue to at least 22 percent of GDP;

5) Reducing the fiscal deficit to 4.8 percent of GDP; and

6) Limiting domestic borrowing to no more than 2.5 percent of GDP.

Given the foregoing resource envelope and key objectives, expenditure policies to be implemented in 2024 are premised on the thematic areas of the Eight National Development Plan (8NDP) i.e. Economic Transformation & Job Creation, Human & Social Development, Environmental Sustainability, and Good Governance Environment.

A. ECONOMIC TRANSFORMATION & JOB CREATION

K40 billion was approved by Parliament under this pillar for the following sectors:

1) Roads: The Government will construct, rehabilitate, and maintain roads, including feeder roads across the country at a cost of K8.3 billion;

2) Agriculture, Fisheries and livestock: K13.8 billion was approved, of which:

i) Implementation of the Farmer Input Support Programme (FISP), K8.6 billion;

ii) Purchase of grains, K1.7 billion;

iii) Irrigation and farm block development, K598.4 million; and,

iv) Animal Disease Control, K498 million.

3) CDF: I take this opportunity to confirm that the entire 2023 CDF allocation was released by the close of December, 2023. Residual CDF funds from 2023 have been retained for use by each constituency this year. On the other hand, Parliament approved the increase of total CDF allocation to K4.8 billion in 2024 from K3.55 Billion in 2023. This means, each constituency will receive K30.6 million in 2024. Compare this to the K28.3 million allocated to them in 2023, let alone, the K1.6 million per constituency allocated in 2021 by the previous administration.

We encourage fellow citizens to take advantage of the CDF bursary facilities to ensure that children are in school.

B. HUMAN AND SOCIAL DEVELOPMENT

Parliament approved K60 billion for the 2024 Budget to implement the following key policy measures:

1) Education: K27.4 billion to be spent on, among others:

a) Recruitment of 4,200 teachers and 1,200 non-teaching staff, K356.1 million;

b) Continuation of the free education policy, K1.9 billion. Of this amount, K518.4 million has so far been released as school grants to support effective operations of various public schools which are scheduled to open next week.; and

c) Completion of previously abandoned secondary schools, K338.3 million.

2) Health: K20.9 billion to be spent on, among others:

i) Recruitment of 4,000 health personnel, K344.1 million;

ii) Completing construction of remaining 4 mini-hospitals in Phase I & commencing construction of 135 mini-hospitals under Phase II – approx. K239.8 million; and,

iii) Procuring medicines and medical supplies to support delivery of health services – K5 billion.

3) Housing and Community Amenities: Parliament approved K2.7 billion to construct 28 dams and rehabilitate 6 others.

4) Public Service Pension Fund: Parliament approved K3.9 billion for the Public Service Pension Fund in an effort to reduce the waiting time for pension payments.

C. ENVIRONMENTAL SUSTAINABILITY

Parliament approved K1.4 billion for implementation of environmental protection programmes and to aid build resilience against the effects of climate change in line with the COP 28 Agenda.

In addition, 50 automatic weather stations will be installed to improve weather advisory services to the agriculture community and other stakeholders.

D. GOOD GOVERNANCE ENVIRONMENT

Among other policy measures, the following were approved by Parliament:

1) Reduce budget deficit on cash basis, to 4.8 percent of GDP from projected outturn of 5.3 percent in 2023;

2) Enhance compliance by implementing tax administrative interventions that leverage on technology – and changing the operating model for the Zambia Revenue Authority; and,

3) Commence consultations to introduce a unified Tax Administration Act to enable the harmonisation of tax treatment across different tax types and ease tax administration.

To support the above-mentioned expenditure policies, we will raise domestic revenues amounting to K141.1 billion, broken down as follows:

1) K61.3 billion or 34 percent of the 2024 budget from Income Tax;

2) K36.4 billion or 20 percent of the budget from Value Added Tax;

3) K16.9 billion or 9 percent of the budget from Customs and Excise duties (including export duties); and,

4) K26.5 billion or 15 percent of the budget from Non-Tax Revenue (Fees, Levies, Fines etc).

SOME EMPOWERMENT & BUSINESS FACILITATION INTERVENTIONS IN THE 2024 BUDGET

1) CDF Community Projects, K2.88 billion;

2) CDF Youth & Empowerment Facility, K955.8 million;

3) CDF School & Skills Development Bursaries, K942.9 million;

4) Women Empowerment (Cabinet Office – Gender Division), K16 million;

5) Youth Empowerment (Ministry of Youth Sports & Arts), K31.2 million;

6) School Feeding Programme, K111.7 million;

7) Food Security Pack, K1.2 billion;

8 Social Cash Transfer, K4.1 billion;

9) Livelihood Empowerment Scheme (Ministry of Community Development), K102.3 million;

10) Farmer Input Support Programme, K8.6 billion;

11) Credit Guarantee Scheme, K386 million;

12) SME Empowerment Funds (CEEC), K391.9 million; and,

13) Public Sector Credit Facility, K150 million.

RESOURCE MOBILISATION

To raise the domestic revenues, Parliament authorized the Government to implement the following revenue measures, according to the tax type:

1) INCOME

a) Extend the 2 percent local content allowance on income earned from value addition to sorghum and millet in order to encourage local value addition;

b) Provide tax holiday for producers of seeds, ginning and spinning of cotton in order to revitalize the cotton value chain;

c) Increase the Pay-As-You-Earn tax-free threshold for individuals to sixty-one-thousand-two-hundred Kwacha per annum from fifty-seven-thousand-six-hundred Kwacha per annum. Parliament also gave us authority to reduce the top-marginal tax rate to thirty-seven percent, and adjust the income bands accordingly; and,

d) Increase the discount on applicable corporate income tax rate from 14.2 percent to 20 percent for first 5 years of operation, for all businesses in rural areas, except mining.

2) CUSTOMS AND EXCISE

a) Remove customs duty on electric motor cycles, electric vehicles, electric buses, electric trucks, and attendant accessories such as charging systems;

b) Reduce excise duty to 25 percent from 30 percent on hybrid vehicles designed for the transportation of persons;

c) Remove customs duty on machinery, equipment and other goods designed for petroleum exploration;

d) Remove customs duty on machinery, equipment and other goods designed for geothermal energy activities; and,

e) Expand the list of selected media, film and music equipment for which customs duty was suspended in the 2023 Budget. The relief on customs duty will be for a period of 3 years.

3) VALUE ADDED TAX

a) Increase the period in which a business can claim a refund on VAT incurred on eligible goods before the commencement of commercial operations to 7 years from the current 4 years for hydroelectricity generation in order to promote power generation; and,

b) Increase the period in which a business can claim a refund on VAT incurred on eligible goods before the commencement of commercial operations to 7 years from the current 4 years for hydroelectricity generation.

4) NON-TAX

a) Increase toll tariffs for heavy duty trucks with 4 axle and above by K100 and abnormal load vehicles by K300; and

b) Introduce a levy of between 8 ngwee and K1.80 on the transaction value for person-to-person mobile money transfers.

5) ANNUAL BORROWING PLAN (ABP)

a) Parliament gave authority to Government to borrow K33.3 billion translating into 19 percent of the budget or 5.2 percent of GDP;

b) The K33.3 billion borrowing will be financed through domestic and external borrowing amounting to K16.3 billion and K17.0 billion respectively;

c) Domestic financing will be raised through the issuance of Treasury Bills and Government Bonds, while external financing is mainly from disbursements on already contracted loans as approved in the ABP;

d) Contraction of any new external loan will be restricted to concessional terms, largely from multilateral lenders such as the World Bank and African Development Bank. As part of performance tracking, the Ministry will provide updates to the National Assembly on the implementation of the 2024 ABP, at mid and end year;

e) To restore debt sustainability, the Ministry will continue to make progress on the debt restructuring exercise. The debt restructuring once concluded will free up financial resources which will be channelled to strategic social and economic sectors.

6) DEVELOPMENT COOPERATION

a) Grants from co-operating partners amounting to K3.4 billion translating to 2 percent of the Budget;

b) 3rd IMF ECF Review in April, 2024 and 4th in October or November, 2024. We anticipate more disbursements from the fund this year, once successfully reviewed. We will stick to the ECF programme objectives as that is what our economy requires to continue its recovery.

7) BUDGET RELATED LEGISLATION

To support the implementation of the 2024 National Budget, Parliament approved the following legislation:

a) The Mobile Money Transaction Levy Act No. 16 of 2023;

b) The Income Tax (Amendment) Act No. 22 of 2023;

c) The Customs and Excise (Amendment) Act No. 25 of 2023;

d) The Zambia Revenue Authority (Amendment) Act No. 26 of 2023;

e) The Value Added Tax (Amendment) Act, No. 27 of 2023; and,

f) The Appropriation Act No. 29 of 2023.

8 CONCLUSION

a) 2024 is the year for further unlocking Zambia’s economic potential (budget theme);

b) Above measures are targeted at growth, especially with action taken to increase CDF, boost productivity in the agriculture and livestock sector, and accelerate mining production through KCM, Mopani and other existing and future players;

c) The public sector has been positioned to ensure that all efforts are made to lessen the encumbrances faced by citizens in doing business;

d) Continue with zero tolerance to corruption and prudent financial management; and,

e) Having acquired the support of Parliament, we need the support of all other citizens to ensure that the 2024 Budget is implemented smoothly.

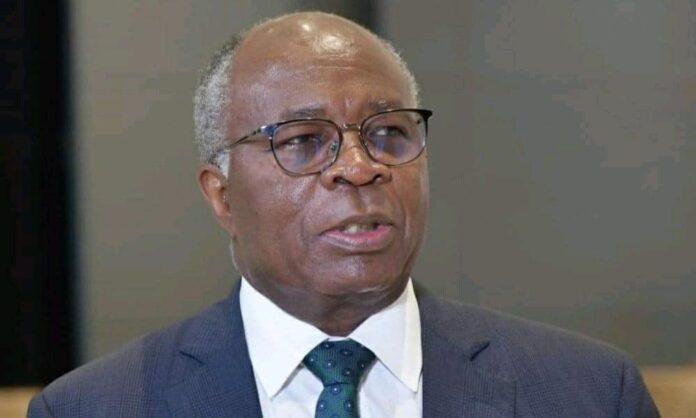

Delivered By:

Dr SITUMBEKO MUSOKOTWANE, MP

MINISTER OF FINANCE AND NATIONAL PLANNING

Messed up budget. Crooked. How much of the national budget was spent on President’s glove trotting trips, ministers’ and MPs salaries allowances and meaningless trips? Zambia is better without politicians