THE COLLAPSE OF INVESTRUST BANK: A new model of managing national assets urgently needed!

Yesterday, Tuesday, April 2, 2024, the Bank of Zambia (BOZ) took possession of the management and control of Investrust Bank Plc (IBP). Apart from Zambia Industrial Commercial Bank (ZICB), IBP is the only other truly indigenously owned and controlled bank in Zambia. For contexts’ sake, as of June 30, 2023, close to 95% of the banking assets in Zambia are foreign owned and controlled. With the sad news at IBP, this paltry stake we hold in the ownership of financial assets has been diluted further to near zero. Every patriot must be worried about this. You cannot be truly sovereign if the financial and banking assets are controlled and owned by foreign interests.

In our view, the problems at IBP are symbolic of what happens in any industry when state actors throw their national’s interests and assets to the wolves of international monopoly capital. In the Socialist Party, we will heighten support to state owned banks and encourage indigenous Zambians to own and manage banks and financial institutions.

The government must support local banks unapologetically.

The takeover of IBP is primarily because state institutions, which are key institutional investors, do not have a deliberate policy to support local banks and local financial institutions. The rise of Nigeria as an economic giant in Africa can be traced to decisions made in the late 1980s under the leadership of Gen Ibrahim Babangida where all federal and state finances were to be deposited (not in foreign banks) but in newly created Nigerian owned banks. The result is a robust Nigerian financial and banking system, which has now made Nigeria the banking and financial services Mecca of Africa. Patriots, imagine for once that NAPSA, NHIMA, Workers Compensation funds were exclusively deposited in local banks like ZICB, IBP, Zanaco, Indo Zambia, NATSAVE and ZNBS? I am not even talking about ministries and spending agencies in government! In 5 years’ time, these institutions will become market leaders and control the economic barometer of our land. Today, the top 5 banks by asset and earnings in Zambia are overwhelmingly foreign. This is a ticking time bomb. There is no economy where a government flirts and dates with all things foreign. Are the leading banks in Egypt foreign owned? Are the major banks in South Africa and Ethiopia foreign owned?

We know that by the time BoZ was making this decision, they had several engagements with the shareholder ZCCM-IH, which falls under CDC chaired by the President. Why did IDC not intervene and bail out a local bank? Who bewitched us!

The UPND’s chaotic monetary policies are worrying.

The IBP failure also exposes the UPND’s chaotic monetary policy of siphoning liquidity through increased Statutory Reserve Ratio (SRR) to 14.5%. At the same time Monetary Policy Rate (MPR) was increased to 12.5%. When you add the mopping up of nearly K2bn in January 2024, these knee-jerk reactions were bound to cause unimaginable disaster. This has milked away all the cash in the market.

Today, there’s no support for local businesses worth talking about.

It has been worse for our local banks whose main clients are local contractors whose invoices have never been paid for nearly 3 years. Whilst international banks are well funded and capitalised, you can’t say the same for our local unsupported banks. Also don’t forget that most local businesses who bank with local banks have been shunned by the UPND government in preference for foreign companies. The government must reverse the draconian monetary policy that has crippled the banking industry before more local banks and financial institutions are swept away in the way of bank failures. The government must also settle the billions of money they owe local contractors and suppliers on the pretext that they are PF cadres. These are the businesses that transact with local banks. The big multinational foreign investors bank with their own foreign banks.

Governance and management weaknesses at IBP should also not be ignored.

Of course, we are aware that IBP has had historical governance weaknesses and management

incompetencies. We are aware of how high impact and productive senior management were frustrated and sidelined out of the bank. The bank was not short of cronyism, tribalism, and even outright abuse and fraud by stakeholders. If the boards and management of IBP in years gone by had made more professional decisions, the course of the bank would be different. We are also aware of the corporate wars that happened at the bank. We are also aware of how ZCCM-IH was literary forced to acquire that shareholding against internal ZCCM-IH management and board due diligence. There was no value in the deal, and Rupiah Banda’s State House forced that deal on ZCCM-IH. But this is a story for another day.

Incompetence at the Bank of Zambia should not also be ignored.

Where is the Bank of Zambia in all this? Can it be said that BoZ was not aware of the systemic problems at IBP until now? We don’t think so. When did IBP last publish its financial statements as required by the Banking and Financial Services Act 2017? The leadership challenges at the central bank are in public. At a deeper level, we have a central bank that is inept and an acolyte of Western and textbook monetary policies that have no meaningful value for our local industry and our people. Under Socialist Party, the Bank of Zambia will be reformed to make it an instrument that helps to elevate the standards of living for our people. What use is double-digit GDP and single digit inflation if our people are hungry and poor? If our people are excluded from participating in commerce and enterprise through artificially propped up interest rates? The reforms at BoZ are long overdue.

Under the SP, we will identify financial institutions and support them to run profitably, but these must be Zambian owned and controlled. State resources will be banked in the local banks as part of the deepening of our local financial systems.

For now, and as a matter of national urgency and emergency, we demand that the government and the central bank move in to forestall financial sector confidence. The mounting loss of confidence in Zambian owned financial institutions is a serious national risk to our financial system. If this is not done, we shall see contagion risk spread to ZICB, NATSAVE, Zanaco, and ZNBS. We cannot afford to lose these national assets and institutions regardless of their weaknesses. SP already has a master plan to come revive our own local financial houses. We will use this critical artery to catalyse a national economic renaissance that is rooted in our own people, our own systems, and for our own national, not monopoly capital interests.

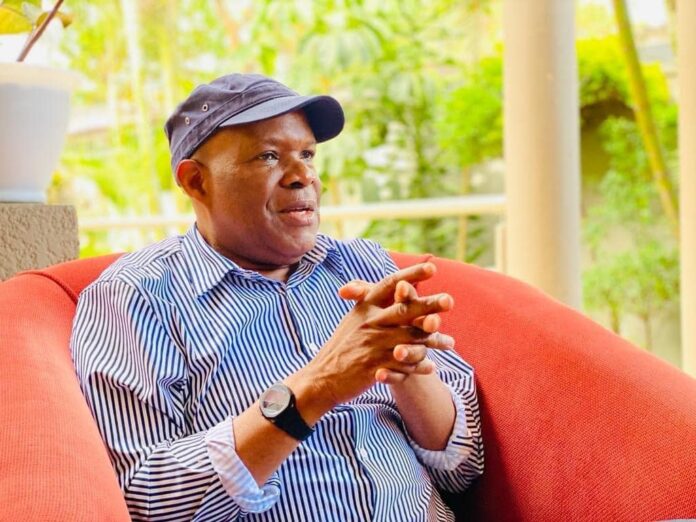

Fred M’membe

President of the Socialist Party

Mr Mmembe. You have been mentioned as one of the bad debtors that contributed to the collapse of investrust. Please respond to that allegation instead of feeding us with communist vitriol.

Fred, your hands are not clean on this one! We understand you borrowed from IBP and as usual, you don’t pay back. So because you didn’t pay back, like what you did to Zambia Airways, the bank has closed. You are just pretending; you are happy because no one will ask you to pay back. In the first place, most companies under IDC are losses making. ZCCM-ICH makes profit but I don’t think using that money to recapitalize IBP would be the best idea

That Matero Dr qouted a Bemba proverb that “imputi isula, taibula kuwekeshapo”. Other than aptly describing Matero Dr’s self, it also describes aFuledi matako. aFuledi first it was Zambian Airways, the borrowed and never paid back the company collapsed. Continue now Investrust same thing bank collapse.

Not forgetting aFuledi’s tax evasion and failure to remit NAPSA deductions but still feels he can manage the country’s financial affairs best?

Maybe it’s the Vaseline kuMatako making him dillusional???

Fred Mmembe, Sir your article basically deflects the issue raised with socialist rethoric.

You can not come here and give an objective response to a matter where you failed to honour your obligations to a financial institution. The facts are clear Mr. Mmembe you contractually signed a loan and failed to honour your contractual obligation. No buts about it.

After failing in the business world, you want to sing a song about socialism? What crass!…

Be like your honourable predecessors. Who when their banks and business failed, they retreated and led quiet, respectable lives. Basically licked their wounds. The arrogance with which you make suggestions should sometimes embarass any person with a concious but sadly, you dont. Save the little dignity that you dont have by keeping quiet on the issue instead of showing us who you really are. A stuborn failure….

Typical Fred, long Article but little meaning. His propositions on paper are valid but in practice they are a Disaster. What happened to Lima Bank, Meriduen Bank, old CEEC, DBZ, Post Newspaper and now Investrust? Any Organisation set up to benefit Zambian Entrepreneurs, us Zambians we loot and plunder because of our insatiable appetite for free things, especially Politicians and their connected Networks. It’s stupidity and lack of responsibility to always blame foreign companies and their capital.Foreigners tend to run their businesses astutely and properly. Take a leaf from the Indian run companies here in Zambia. We are just loud Mouths and zero on responsibility

Ashula mmembe nafuti. Chinyenyenye mmembe